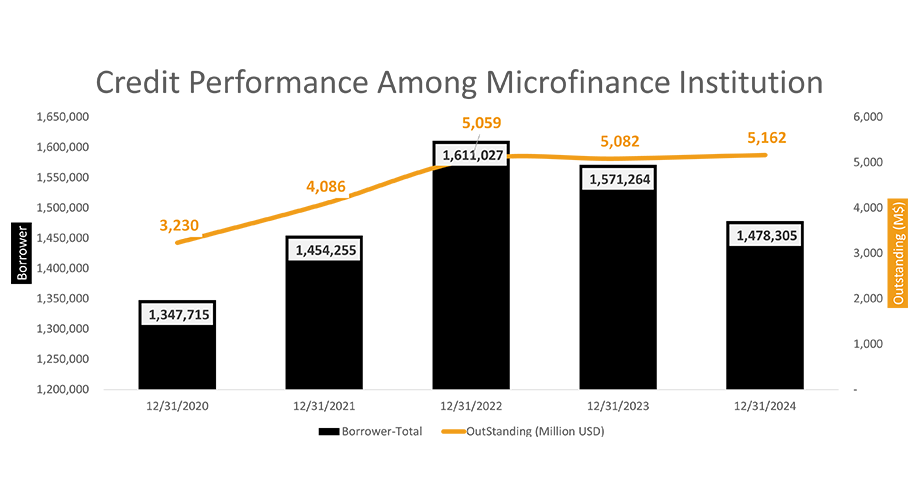

The microfinance sector in Cambodia has evolved significantly over the past decade, becoming an essential component of the country’s financial landscape. As of 2024, the sector is marked by a slight decline in the number of borrowers while witnessing a modest increase in total loan outstanding.

As of December 2024, the total number of microfinance borrowers in Cambodia has decreased to approximately 1,478,305, down from 1,571,264 in December 2023. This decline in borrower numbers indicates potential challenges in reaching new clients or retaining existing ones amid changing economic conditions. Conversely, the total loan outstanding in the sector has increased from $5.082 billion in December 2023 to $5.162 billion in December 2024. This growth suggests that while fewer individuals are accessing microfinance services, those who do are likely seeking larger loans, reflecting changing financial needs and possibly a strategic shift toward more significant investments.

This circular encourages institutions to adopt flexible repayment terms and to consider the economic circumstances of borrowers, thereby facilitating a more supportive environment for those in distress. Additionally, the Association of Banks in Cambodia and the Cambodia Microfinance Association have issued statements outlining measures to support clients during these difficult times, emphasizing the importance of collaboration among stakeholders. The proactive approach of the NBC, along with the support from the two associations, plays a critical role in stabilizing the sector by ensuring that borrowers have access to options that can help them manage their debts more effectively.

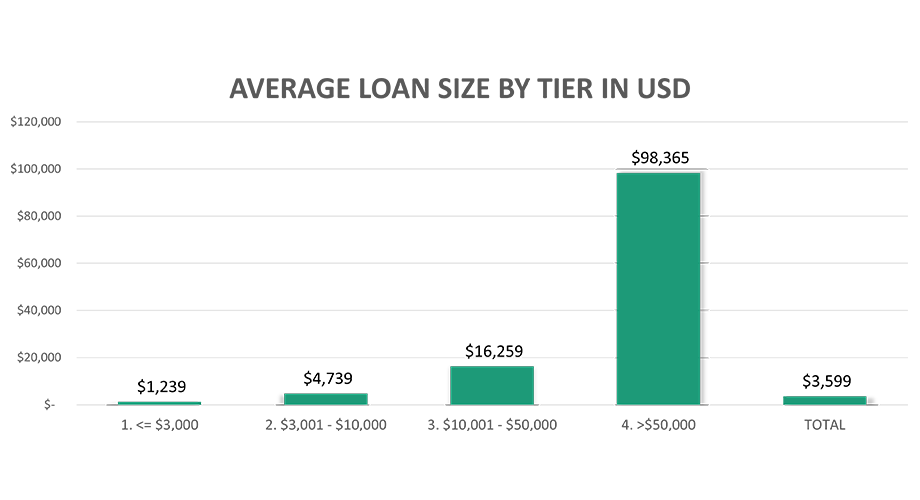

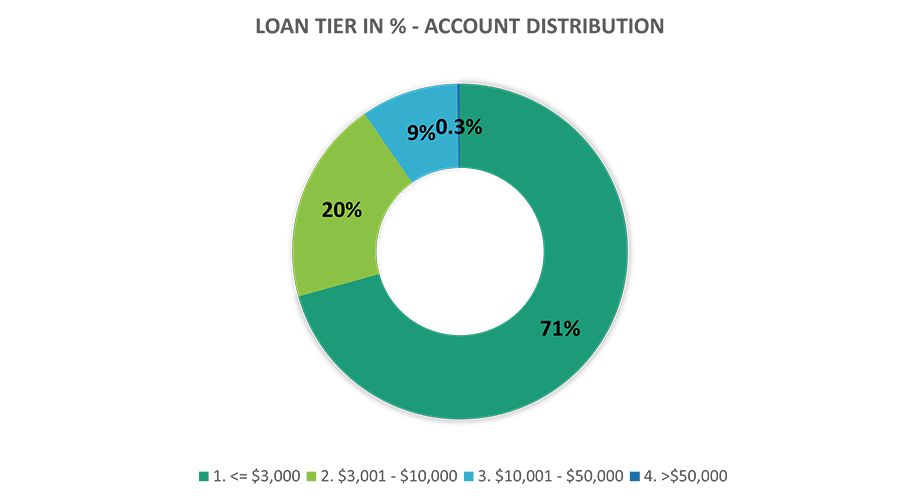

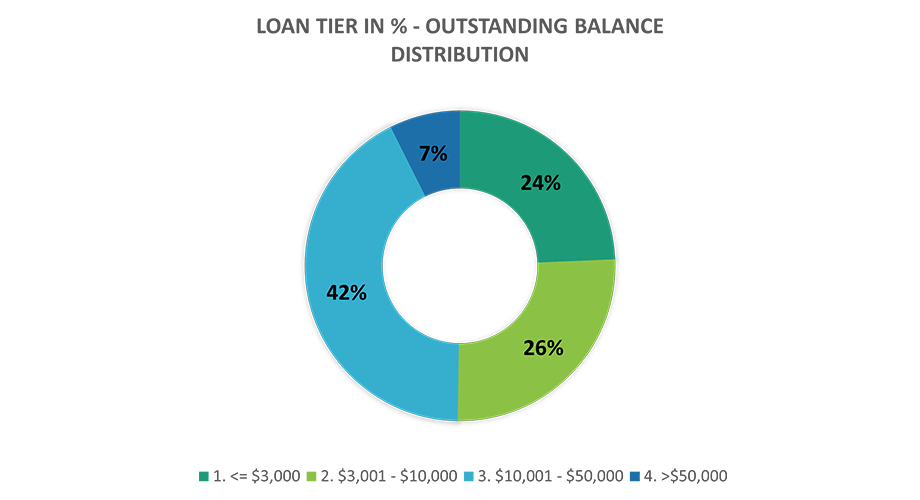

The microfinance sector in Cambodia is marked by a strong emphasis on small loan amounts. As of December 2024, data from Credit Bureau Cambodia (CBC) shows that an impressive 71% of microfinance borrowers are choosing loans of $3,000 or less. This trend reflects the reliance of a significant portion of the population on smaller financial products. However, despite the high percentage of borrowers engaging with these smaller amounts, they account for only 24% of the total loan portfolio. This indicates that the average loan amount for these borrowers is $1,239, which is three times lower than the overall sector average of $3,599.

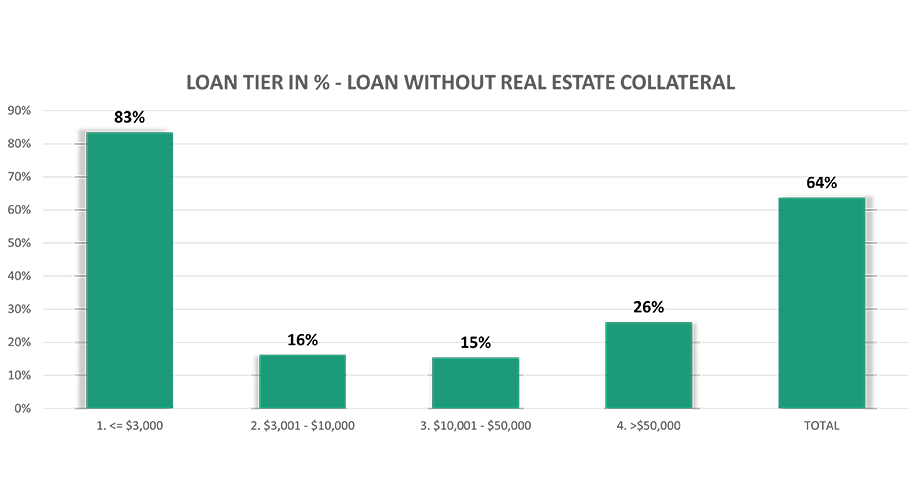

In response to critiques that microfinance in Cambodia increasingly relies on real estate collateral, this graph provides important insights. The overwhelming majority of microfinance borrowers are obtaining smaller loans without real estate as collateral, which indicates a different trend than the critics suggest - about 83% of borrowers opting for loans of $3,000 or less. Instead of a shift toward more significant collateral requirements, the data highlights a preference and necessity among borrowers for small, unsecured loans that support their immediate financial needs. This indicates a substantial reliance on modest financial products among the microfinance clientele.

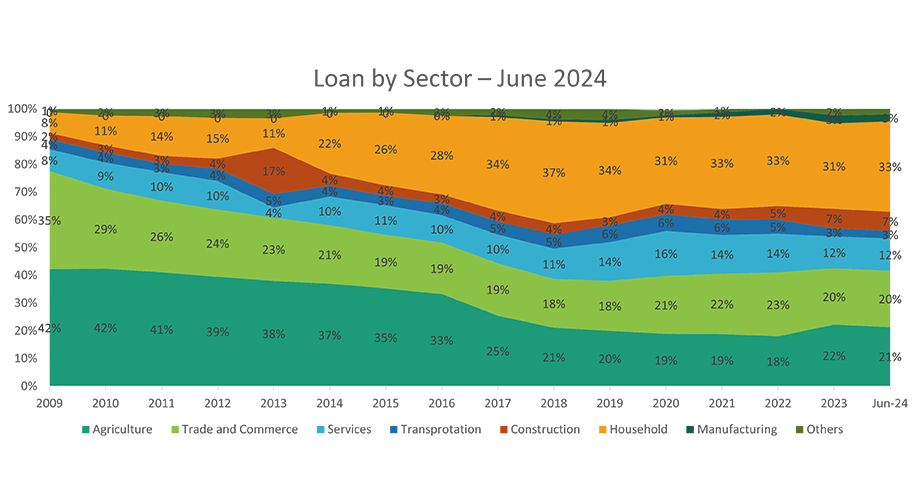

There is a significant shift in the distribution of loans across various sectors in Cambodia from 2009 to June 2024. Notably, the agriculture sector has experienced a decline from 42% in 2009 to 21% in 2024, indicating a reduction in reliance on agricultural financing. The decrease in agricultural loans raises concerns about the sustainability of the agricultural sector in Cambodia. As farmers may be facing challenges such as climate change, fluctuating commodity prices, and increased competition, the drop in agricultural financing could adversely impact food security and rural economies.

The trade and commerce sectors have shown a gradual decrease over the years, moving from 35% in 2009 to 20%. While it remains a significant portion of the loan portfolio, the decline suggests a degree of stabilization or saturation in lending within this sector. Conversely, the services sector has seen a steady increase from 8% to 12%, highlighting a growing demand for financial support in areas like retail and hospitality. The construction sector has also gained traction, rising from 2% to 7%, likely due to increased investment in infrastructure.

One of the most striking changes is seen in the household sector, which surged from 8% in 2009 to an impressive 33% by June 2024. This substantial increase indicates a growing reliance on microfinance for personal financial needs, which may encompass household expenditures, education, healthcare, and consumption. The emphasis on household loans may signal a shift towards personal debt, potentially leading to financial distress if not managed carefully. These trends underscore the importance for microfinance institutions and policymakers to adapt their strategies, ensuring that financial products remain accessible and tailored to the diverse needs of individual households.

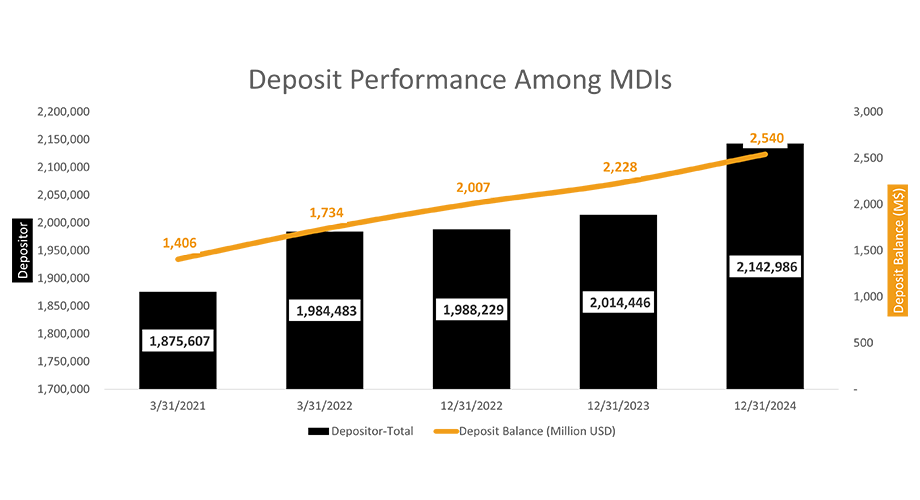

The number of depositors has shown an incremental increase, growing from about 1.17 million in March 2020 to approximately 2.14 million by December 2024. Simultaneously, the total deposit balance has exhibited robust growth, rising from around $1.77 billion to $2.54 billion during the same period. This upward trend in both metrics indicates increasing public confidence in microfinance institutions as vital financial intermediaries. The steady rise in depositors reflects a growing trend of financial inclusion, as more individuals and families seek to secure their savings and access financial services through microfinance platforms.

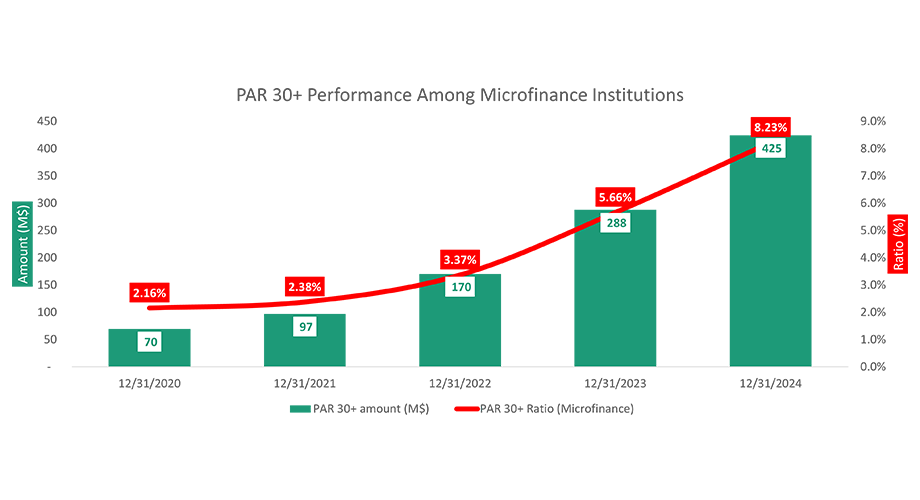

Despite the microfinance sector's overall positive trajectory, several challenges remain. The decline in the number of borrowers raises concerns about accessibility and the effectiveness of outreach strategies. The rising PAR ratio 30+ is a significant concern that warrants attention. Economic fluctuations can disproportionately impact vulnerable borrowers, increasing the risk of default. MFIs must prioritize effective risk management strategies, closely monitoring loan performance, and implementing supportive measures for borrowers at risk of defaulting.

In conclusion, while the microfinance sector has made significant strides in fostering financial inclusion and supporting economic development, ongoing efforts are needed to address the challenges ahead. By promoting responsible lending practices, enhancing financial literacy, and embracing technology, the microfinance sector can solidify its role as a vital component of Cambodia's financial ecosystem, contributing to sustainable economic growth and improved livelihoods for its citizens.