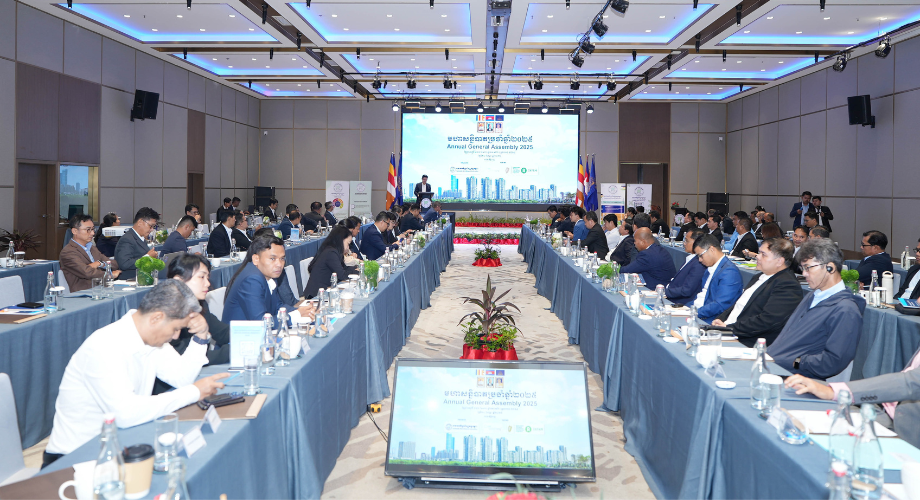

The Cambodia Microfinance Association (CMA), On 20 February 2025, organized its 2025 Annual General Meeting (AGM) to review the progress and achievements of the microfinance sector in 2024 and to highlight the association's work direction and key action plans for 2025. This important annual event was attended by CMA's leadership, including board members, senior representatives from member financial institutions, and numerous stakeholders.

During the event, participants received an overview of Cambodia's microfinance sector landscape and the challenges posed by global and regional tensions, as well as other uncertainties faced by the sector. The efforts undertaken by CMA, its members, and stakeholders to address or alleviate these challenges were also presented. Furthermore, the event highlighted initiatives such as sector pool funds, aimed at mobilizing funds for projects benefiting the sector.

Addressing more than 100 participants, H.E. Dith Nita, CMA Chairwoman of the Board of Directors, emphasized the sector’s contribution to economic and social development. She stated, “The microfinance sector has made significant contributions to Cambodia’s economic and social development by providing responsible financial services and customer protection to low-income families and in remote areas to support their livelihoods.” She added, “As of the end of 2024, the microfinance sector had supported more than 1.48 million people and provided loans totaling approximately US$5.16 billion. The deposit balance was over US$2.54 billion from 2.14 million accounts, and the sector employed more than 21,200 individuals across a total of 914 offices.”

At this annual event, Mr. Wilson Soo of SEVEA Consulting Firm delivered a presentation on “Designing Green Finance Instruments in the MFI Sector.” The presentation aimed to disseminate a study finding on green finance products suitable for the microfinance sector in Cambodia. The goal is to support the growth and sustainability of green businesses by providing them with better access to financial services.

Introducing the presentation, Mr. Kea Boran, Board Member and Chairman of the CMA’s Financial Inclusion and Self-Regulation Committee, highlighted the importance of this study. He noted that it would serve as a valuable document to assist CMA’s members in designing and developing credit products and capturing in-demand market share. He also expressed his deep gratitude to Oxfam in Cambodia for supporting this study.

Mr. Sok Khim, Program Manager of Oxfam in Cambodia, also spoke about the vulnerability arising from climate change and the government’s key policies to make Cambodia a carbon-neutral country by 2050. The results of the study on green finance products are part of the implementation of the Climate Resilience For All (CREFA) project, which is supported by the Embassy of Ireland (Irish Aid) through Oxfam in Cambodia.